ending work in process inventory calculation

Ending inventory calculation examples. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed.

Wip Inventory Definition Examples Of Work In Progress Inventory

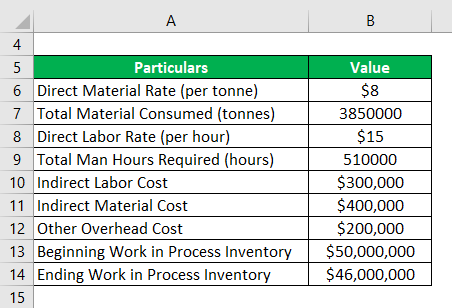

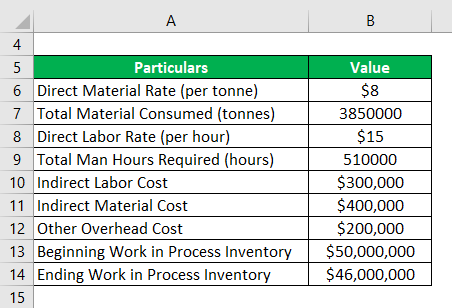

Assume that Raw Materials Inventory contains only direct materials.

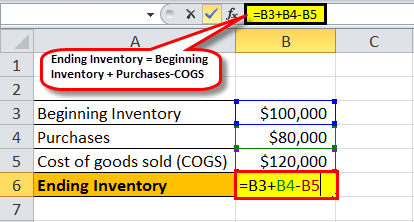

. The following are examples of how to calculate ending inventory using the FIFO LIFO and WAC methods. In this example the beginning work in process total for June is 50000. Ending Inventory 20000.

Begin by identifying the correct formula to calculate the ending work-in-process inventory on December 31 2017. Calculate the additions to the work-in-process inventory account for the direct material used direct labor and manufacturing overhead. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of.

Calculate the companys predetermined overhead application rate. Calculate the finished-goods inventory for the 123102 balance sheet. This inventory requires additional processing before it can be classified as finished goods inventory.

To calculate WIP inventory you need the beginning work in process inventory and to calculate that you need the ending work in process inventory. Thus your ending WIP inventory comes out to be 100000 for the year. The team at BlueCart says that both calculations are the same.

And C c cost of goods completed. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Calculate Ending Work in Process.

Beginning work in process inventory is actually the same thing as ending work in process inventory just for a different accounting period. Find the beginning work in progress WIP. Ending Work in Process WIP Inventory COGM.

Another method available to calculate ending inventory is the work in process method. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. Formulas to Calculate Work in Process.

The Work in Process Inventory account had a beginning balance of 26000 and an ending balance of 24000. WIP b beginning work in process. P4-42 Cole Company uses normal costing in.

The total cost allocated to units in ending work-in-process inventory must be calculated separately for direct materials and conversion costs. Businesses always calculate WIP inventory at the end of accounting periods whether that be a quarter year or some other time period. Beginning WIP DM DL MOH Cost of goods manufactured Ending WIP.

The last quarters ending work in process inventory stands at 10000. In fact the beginning work-in-process formula is essentially the endings formula. The only difference is the accounting period.

Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net purchases and subtract the prices of products sold from their sum and you get the value for the ending inventory as shown below. Partially completed inventory is known as work in process is inventory. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process.

The work-in-process inventory is calculated at the end of the accounting period. How to use our calculator. What is the difference between work in process and work in progress inventory The terms work in process and work in progress are oftentimes used interchangeably but depending on the industry they could mean something different.

Harods Company has a beginning inventory of 1000 units of product and purchases another 1000 units at 5 each during the first month of an accounting period. In this equation WIP e ending work in process. The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000.

Work in Process WIP Finished Goods. For example lets say that a company that manufactures furniture incurs the following costs. The first step is to calculate the direct materials used during the year.

Every dollar invested in unsold inventory represents risk. Work in Process Overview Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. 12312017 The ending work-in-process inventory on December 31 2017 is 670000.

Ending Inventory 65000 - 45000. C m cost of manufacturing. How to calculate ending inventory using the work in the process method.

The calculation of ending work in process is. Ending WIP Inventory Beginning WIP Inventory Production Costs Finished Goods Cost. WIP e WIP b C m - C c.

Compute the cost of Goods Manufactured for the year. Ending WIP is listed on the companys balance sheet along with amounts for raw materials and finished goods. Calculate the over-applied or under-applied overhead at year-end.

The formula for ending work in process is relatively simple. Heres how it looks. Lets calculate Company As ending WIP inventory as per the formula.

Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account. The beginning work-in-process is the same as the end work-in-process. Calculate the ending Work in Process Inventory balance on June 30.

Ending inventory using retail Cost of goods available Cost of goods sold during the period. Keeping this in consideration how do you calculate work in process inventory. This ending inventory figure is listed as a current asset on a balance sheet.

This answer results from dividing the total costs of 50000 by the 10000 units started and multiplying the result by the 500 equivalent units in conversion costs in ending work-in-process inventory. 3 Methods to Calculate the Ending Inventory. The raw material is direct material inventory work in progress inventory is partially completed inventory and finished goods inventory is stock that has completed all stages of production.

Work-in- process Work-in-process 112017 Total manufacturing cost - Cost of finished goods manuf. Ending WIP is listed on the companys balance sheet along with amounts for raw materials and finished goods.

Work In Process Wip Inventory Youtube

Ending Inventory Formula Step By Step Calculation Examples

Ending Work In Process Double Entry Bookkeeping

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template