will capital gains tax rate change in 2021

First deduct the Capital Gains tax-free allowance from your taxable gain. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Capital Gains Tax Advice News Features Tips Kiplinger

Get more tips here.

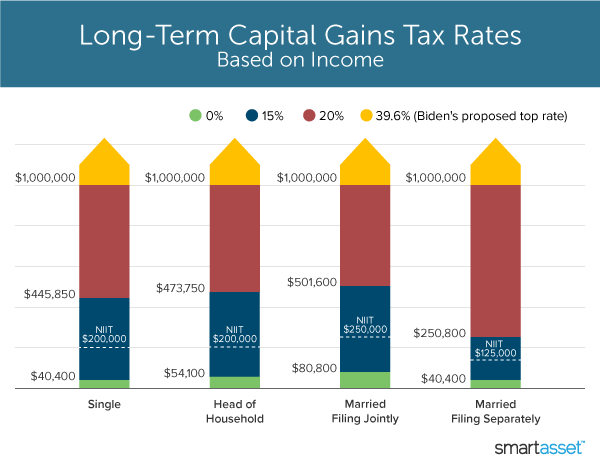

. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. The current long term capital gain tax is graduated. The rates do not stop there.

Events that trigger a disposal include a sale donation exchange loss death and emigration. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Additionally a section 1250 gain the portion of a gain.

The tax rate on most net capital gain is no higher than 15 for most individuals. All Major Categories Covered. Some or all net capital gain may be taxed at 0 if your taxable.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. For example if Julia bought shares in Apple in February and sold them in November of the same year her gain. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Long-term gains still get taxed at rates of 0 15 or 20. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Select Popular Legal Forms Packages of Any Category. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

Long-term gains still get taxed at rates of 0 15 or 20. Discover Helpful Information and Resources on Taxes From AARP. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

The tax rate that applies to a capital gain depends on the type of asset your taxable income and how long you held the property. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. If youre selling stock real estate or a business youve got a 180 day window to act.

Unlike the long-term capital gains tax rate there is no 0. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Those changes are expected to.

Short-term capital gains are taxed like ordinary income at tax rates. 2021 the date House. What Are the Capital Gains Tax Rates for 2022 vs.

Ad Compare Your 2022 Tax Bracket vs. Capital Gain Tax Rates. The current capital gain tax rate for wealthy investors is 20.

The effective date for this increase would be September 13 2021. Weve got all the 2021 and 2022 capital gains. Ad Tip 40 could help you better understand your retirement income taxes.

Add this to your taxable. If youre selling stock real estate or a business youve got a 180 day window to act. The following are some of the specific exclusions.

Includes short and long-term Federal and. Your 2021 Tax Bracket to See Whats Been Adjusted. Download 99 Retirement Tips from Fisher Investments.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Can Capital Gains Push Me Into A Higher Tax Bracket

Trust Tax Rates And Exemptions For 2022 Smartasset

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What S In Biden S Capital Gains Tax Plan Smartasset

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)